In its fifth market review of the sector, the (GSIA) reported that responsible investing grew by 15 per cent from 2018 to 2020. Assets reached $35.3 trillion for the period to make up 36 per cent of global assets professionally managed, a rise of 2 per cent from two years earlier. The figures include retail, wholesale, and institutional assets which carry a sustainable mandate. In developed markets retail investors are increasingly becoming part of the ESG growth story, but the space is still largely driven by institutional investors in developing markets.

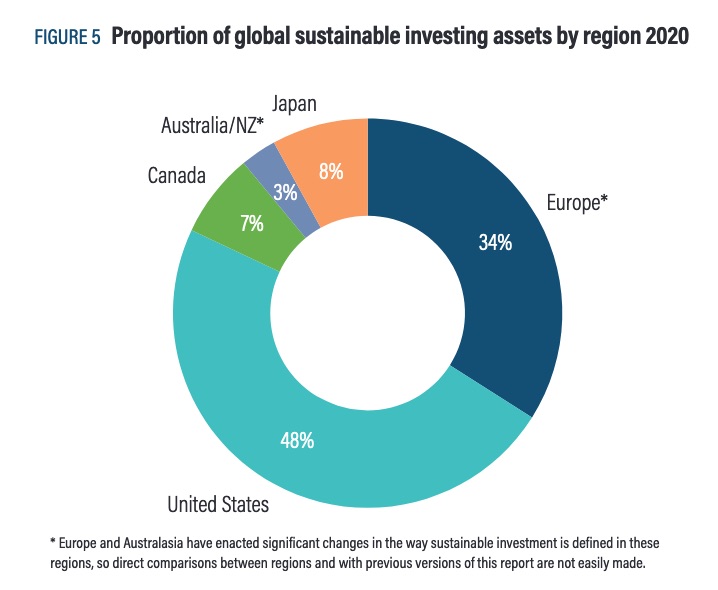

The US and Europe continue to dominate the global slice of the market, holding more than 80 per cent of global sustainable investment assets between 2018 to 2020. See breakdown below.

Some of the strongest regional growth was recorded in North America and Japan. Canada leads the market with a 62 per cent growth in sustainable investment assets, followed by Europe at 42 per cent, Australasia at 38 per cent, the US at 33 per cent and Japan at 24 per cent.

The alliance compiled the report from data submitted by its global members who track sustainable investment activity in their regions. It also takes into account investments that are tackling climate change, for example, but don't fall into an ESG-integrated investment.

As the sector has grown dramatically and been flooded by terminology and competing standards, the alliance said it revised its ESG definitions last October “to reflect the most up-to-date practice and thinking.”

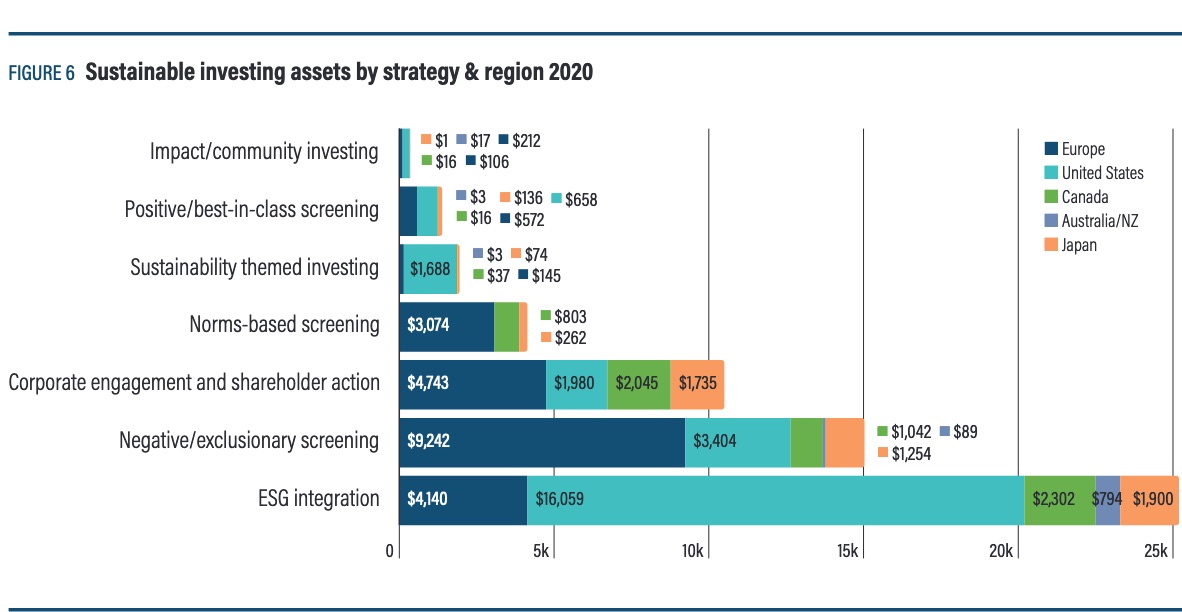

It found that the most common sustainable investment strategy is ESG integration, followed by negative screening, corporate engagement and shareholder action, norms-based screening and sustainability-themed investment.

Here are those definitions for reference:

The report also paints an industry in transition, highlighting the different paths regions are taking and some of their distinct drivers. This graphic goes some way to explaining how the main markets differ in their sustainable investment approaches and what levers they are using (figures are in billions):

The report found that some regions, such as Europe and Australasia, are slowing down their rate of growth or have seen a reported reversal. “In both cases, this is largely due to changes in how sustainable investment is defined, either by law as in the case of the EU or by new industry standards, as is the case in Australasia,” it said.

Axa Group ESG poll finds clear accounting top priority

ESG appears to be all things to all clients and nothing at all, according to , the firm's investment arm, found that the term ‘ESG’ is only recognised by one in five investors in Europe and one in three in Asia. The term ‘sustainable investing’ registered more strongly, but only among half the investors polled.

Just as the pandemic has shown the power of clear public messaging, ESG is in danger of becoming an investment phenomenon that can only be explained inside the fund management bubble. More clarity is especially important for retail investors if they are to become more comfortable with ESG on their path to financial security, which is their most important investment concern.

Improved transparency is the top call to action to make ESG investing more attractive for investors across Europe and Asia. Improvements in product labelling are also prominent investor demands in both regions. Data protection and cyber security were ranked second and third as priorities.

Getting the terminology surrounding ESG right is important now and for drawing in clients who are yet to invest. Nine in ten non-investors polled by Axa declared ESG factors as "potentially" important when deciding if and how to invest.

“Across financial services, many different terms and phrases attempt to describe products and approaches that do very similar things in the ESG space. But, in the absence of consistent industry standards, this labelling and relabelling, could become a source of confusion. It risks making retail investors less confident in changing their investment behaviours,” the report said.

The perception that ESG mostly equates to tackling climate change is also dispelled. This study found that individuals care about issues across the environmental, social and governance spectrum, with governance factors seen as the most important overall.

The old issue of outcomes

Scepticism among investors about how ESG funds would perform compared with non-ESG funds is largely evaporating. However, ESG funds have a reputation for being more expensive than non-ESG funds. "Fees are an issue that need to be addressed. As does the need for transparency on the nature, objectives and ESG performance of the stock invested in. Our research clearly demonstrates strong appetite for and perceived value in more detailed ESG disclosures," the report said.

The report found that just over half of investors in Europe and 68 per cent in Asia would consider paying more fees to invest in ESG funds, and they overwhelmingly want mandatory detailed information on how the companies they are invested in perform across ESG criteria.

The report concluded that the industry must translate ESG into a format digestible for retail markets. It must do better to understand clients’ needs on ESG-related issues and help educate those clients about how best to incorporate those needs within their portfolios.

A quarter of investors in Europe and Asia claimed that they had not had a conversation with their advisor about ESG or responsible investment factors in the past. Where that had happened, it was as likely to have been initiated by the client as by the advisor.

The survey was conducted online between January and March 2021 in Belgium, France, Germany, Italy, and Spain. In Asia, it was conducted in Hong Kong, Japan, the Philippines, Singapore, Thailand, and Indonesia.